pay income tax online

The Illinois income tax has one tax bracket with a maximum marginal income tax of 495 as of 2022. However if your modified adjusted gross income MAGI is less than 80000 160000 if filing a joint return there is a special deduction allowed for paying interest on a student loan also known as an education loan used for higher education.

If you sold a UK residential property on or after 6 April 2020 and you have tax on gains to pay you can report and pay using a Capital Gains Tax on UK property account.

. Generally personal interest you pay other than certain mortgage interest is not deductible on your tax return. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. If you have annual tax dues exceeding Rs 10000 you must pay income tax in advanceUsually for the salaried class employers take care of.

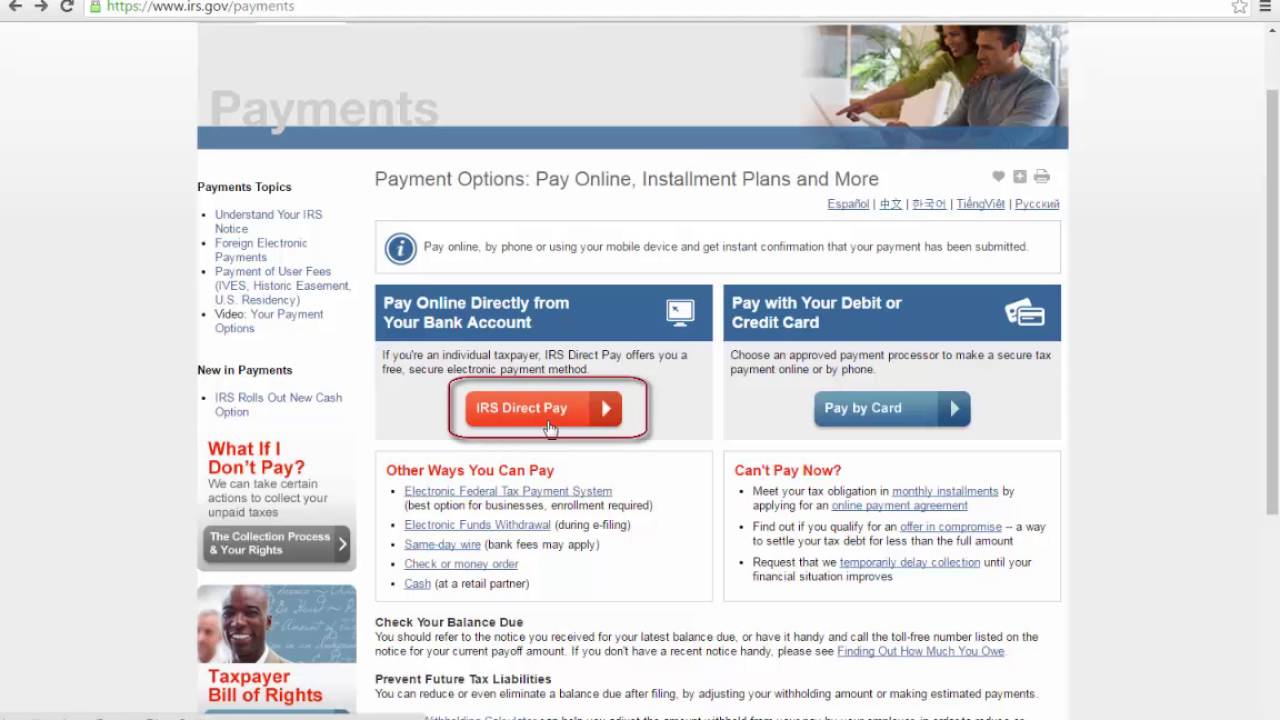

The Maryland income tax has eight tax brackets with a maximum marginal income tax of 575 as of 2022. Make a personal income tax return payment online. There are several payment options with different processing times for each.

View Your Tax Credit. Payment with Return - Check or. Fill them in before you sign print and mail them to the IRS.

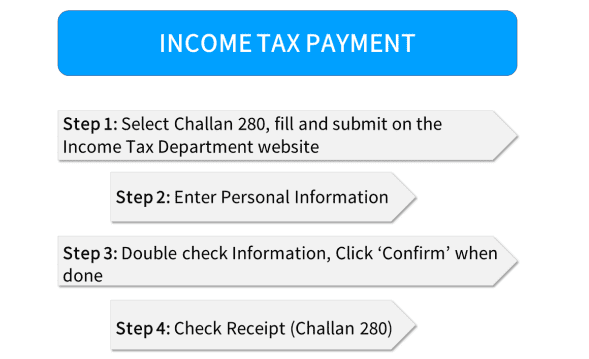

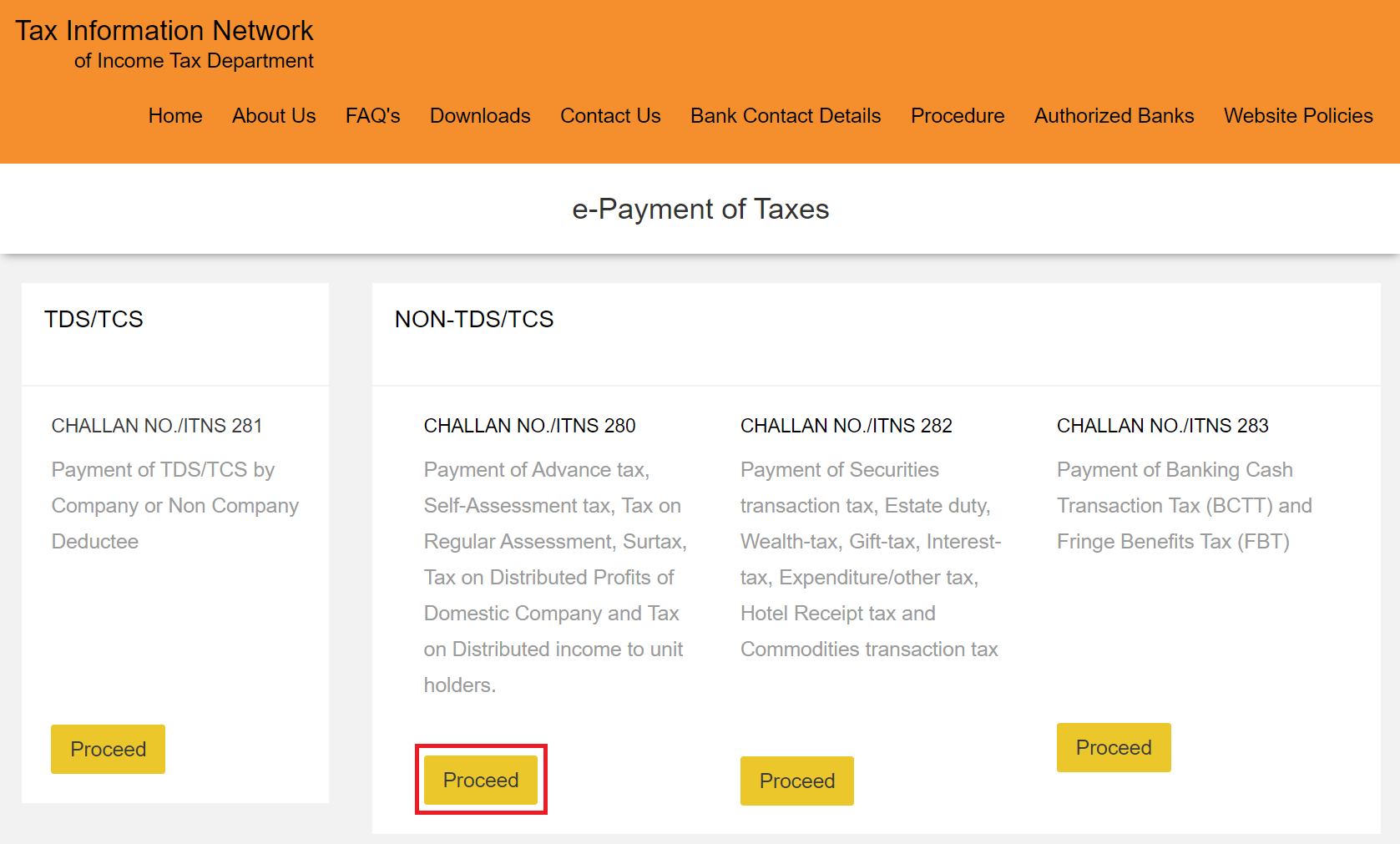

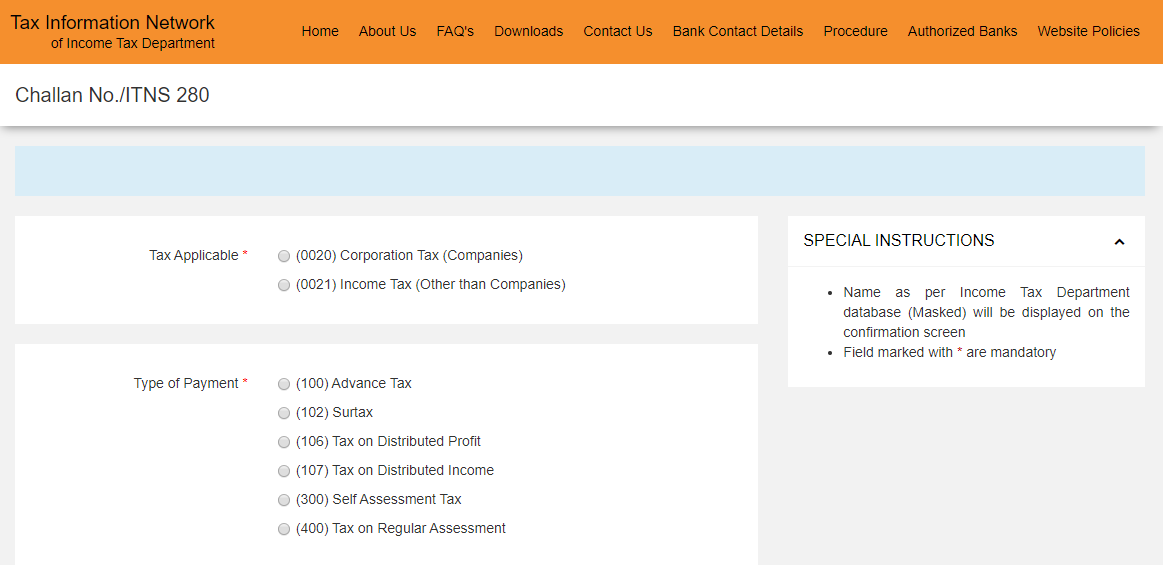

How to pay electronically through our website individuals only You can pay directly from your preferred account or by credit card through your Individual Online Services account. Challan 280 Online Method Offline Method BSR code from Challan 280. Activity Duty Military with adjusted gross income of 73000 or less will also qualify.

Pay-per-click PPC has an advantage over cost per impression in that it conveys information about how effective the advertising was. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Get a quick and easy estimate of your 2022 taxes using our online tax calculator.

In person or by mail. Self-employed individuals generally must pay self-employment SE tax as well as income tax. Online view through e-Filing Website.

There are -918 days left until Tax. Tax codes and tax rates for individuals How tax rates and tax codes work. Self-Employed defined as a return with a Schedule CC-EZ tax form.

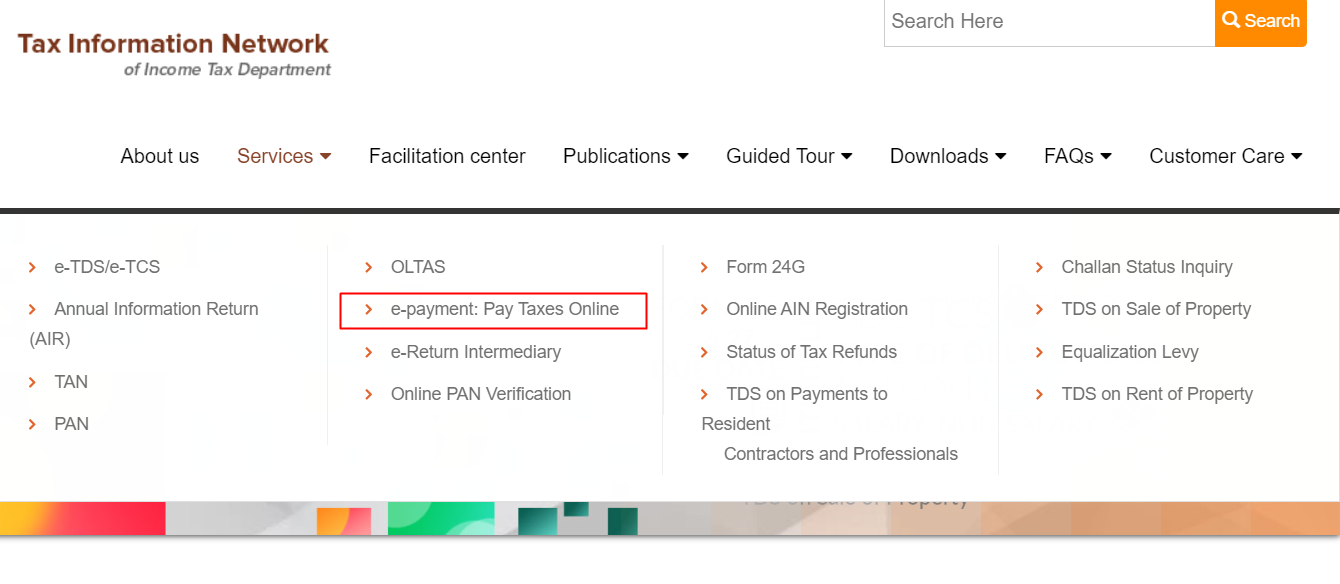

To pay income tax online visit the income tax departments e-filing website. Contains complete individual income tax data. If you would like to make an income tax return payment you can make your payment directly on our website.

Disposing of an asset. You do not pay tax on things like. If you have to pay income taxes to the CRA you can do so online through the CRAs My Payment online portal.

Form 502D is meant to be filed on a quarterly basis. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft.

Find about how to pay advance tax self assessment tax and challan 280. Online view through internet banking. You can pay your tax instalments online in person or by mail.

Plus find everything you need to prepare to file your income taxes. Detailed Illinois state income tax rates and brackets are available on this page. I dont want to e-verify this Income Tax Return and would like to send signed ITR-V through normal or speed post to Centralized Processing Center Income Tax Department Bengaluru 560500.

Clicks are a way to measure attention and interest. On the select e-Pay taxes option income tax department has also introduced a Quick ITR Filing option. When an individual income tax return is filed with a payment in excess of 1000 for single filers and 2000 for joint filers the taxpayer will be notified of the requirement to file an estimated tax declaration and pay the estimated tax.

If the main purpose of an ad is to generate a click or more specifically drive traffic to a destination then pay-per-click is the preferred metric. Form 502E - Extension of Time to File. Whats new for louisiana 2021 individual income tax.

Pay by setting up a pre-authorized debit agreement using CRA My Account or. You must file estimated individual income tax if you are self employed or do not pay sufficient tax withholding. See Tax Forms for other Tax Years and review Tax Planning Tips for future years that help you balance your taxes.

New Users for Online Filing In order to use the Online Tax Filing application you must have already filed a return with the state of Louisiana for the 2004 tax year or later OR you must have a current Louisiana Drivers License or ID card issued by the LA Dept of Motor Vehicles. Visit OLTs Free File Alliance offer. Use your instalment remittance voucher to pay in person or by mail.

Check tax for previous years Theres a different way to check how much Income Tax you paid last year 6. Pay your instalments using an online payment option. Challan 280 - Online Income Tax Payment with Challan 280.

Welcome to Ohios Regional Income Tax Agency RITA with a website designed to make your municipal tax administration service more easily accessible and navigable online. OLT Online Taxes. The first 1000 of income from self-employment - this is your trading allowance the first 1000 of income from property you rent unless youre using.

2017 Federal Income Tax Forms. The forms below can be opened in an online editor. ECheck - You will need your routing number and checking or savings account number.

1 online tax filing solution for self-employed. Quick Payments using GTC - Instructions State Tax Liens Estimated Tax and Assessments only at this time Paper Forms. What happens at the end of the tax year After the end of the tax year we work out if youve paid the right amount of tax.

The statistics are based on a sample of individual income tax returns selected before audit which represents a population of Forms 1040 1040A and 1040EZ including electronic returns. Paying Online The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or eCheck. With forms tools and communication strategies that simplify and increase transparency we are helping individuals businesses and tax professionals navigate the.

The state mailing address is on the state income tax form. If you expect to owe 500 or more on April 15th you must pay your income tax to Illinois quarterly using Form IL-1040-ES. How income gets taxed Income is taxed differently depending on where it comes from.

We either automatically assess you or you need to file an IR3 return. Use our tax code finder and tax on. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

Estimated tax is the method used to pay Social Security and Medicare taxes and income tax because you do not have an employer withholding these taxes. You can also estimate how much Income Tax you should pay this year without signing in. Request a Payment Plan using GTC - Instructions.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Pay Individual Income Tax Online. Options to pay online.

Americas 1 tax preparation provider. The report contains data on sources of income adjusted gross income exemptions deductions taxable income income tax modified.

How To File Belated Return How To Pay Income Tax Online Youtube

Income Tax Online Payment Challan 280 Steps To Pay Tax Online

How To Pay Income Tax Online Taxaj

Tax Day Laggards Consider Filing For Extension If In A Rush Biz New Orleans

Online Tax Payment Know How To Pay Income Tax Online

How To Pay Income Tax Online 2022 23 How To Pay Self Assesement Tax Payment Challan 280 Online Youtube

How To Pay Advance Tax Online Myitreturn Help Center

How To Pay Balance Income Tax Online Wealth18 Com

Irs Tax Payment Plans Installments Or Offer In Compromise

How To Pay Income Tax Online Following 5 Simple Steps

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

Estimated Income Tax Payments For 2022 And 2023 Pay Online

How To Pay Quarterly Income Tax 14 Steps With Pictures

Filing And Payment Income Tax With Online Forms Vector Image

How To Pay Estimated Taxes Brooklyn Fi

How To Pay Calculate Income Tax Dues Online Paisabazaar Com

Filing A 2020 Tax Return Even If You Don T Have To Could Put Money In Your Pocket Internal Revenue Service

Paying Income Taxes Online John G Ullman Associates

How To Pay Income Tax Online In India Finance Guru Speaks The Complete Beginner S Guide To Learn Trading And Investing

Comments

Post a Comment